Medicare Supplement (Medigap) Plans

Medicare Supplement plans are also called “Medigap” plans and can be purchased only if an individual has Original Medicare (Parts A and B). Medigap plans are insurance policies you buy from a private insurance company that pay for some or all the cost sharing, or gaps in coverage, such as deductibles, copays and coinsurance not covered by Original Medicare. Except in three states (Massachusetts, Minnesota, and Wisconsin), Medicare Supplement policies are available in standard types or plans. Each plan is named with a letter of the alphabet. Don’t confuse Medicare Supplement plans A, B, C and D with Parts A, B, C and D of Medicare.

Please call at 561-734-3884 (TTY: 711) or email us at pmcholak@gmail.com for more information about Medicare Supplement plans and for quotes on particular plans from specific carriers.

Medicare Supplement plans are different than Medicare Advantage plans and a beneficiary can NOT have both types of plans.

Medicare Supplement plans presently available for purchase don’t offer coverage for outpatient prescription drugs (nor does Original Medicare), so you must purchase separate Medicare drug coverage (Part D) if you want such coverage.

Medicare Supplement plans are identified by letters (Plans A, B C, D, F, G, K, L, M and N) except in Massachusetts, Minnesota, and Wisconsin. (Plans Hi Deductible F and Hi Deductible G are variants of plans F and G respectively that have annual deductibles. Standardized plans may also be offered in what is called a Medicare SELECT version.)

Note: Plans C, F and Hi Deductible F are no longer available to Medicare-eligibles born January 1,1955 or later who first become eligible for Medicare Part A December 1, 2019 or later. Plan G offers the most benefits to such beneficiaries, and a new Plan Hi Deductible G is now available. Individuals with birthdays before January 1, 1955 who first became eligible for Medicare Part A BEFORE January 1, 2020 are still permitted to purchase Plans C, F, or Hi Deductible F.

Each Medicare Supplement plan with the same letter must offer the same basic benefits, no matter what insurance company sells it.

Medicare Supplement policies sold by insurance companies differ by cost, underwriting criteria, value added benefits, and customer service. Premiums generally vary by age, sex, tobacco usage and zip code. Some carriers have a single “unisex” rate for both genders, and some have separate rates for males and females.

Medicare Supplement insurance companies must follow federal and state laws. A Medicare Supplement policy covers only one person. If a married couple wants Medicare Supplement coverage, they must buy separate Medicare Supplement policies.

Depending on the state, some carriers offer a discount if both spouses purchase a policy (this is called a “spousal discount”) from that carrier, and a few carriers offer a “household discount.” A “household discount” reduces the premium for a single policyholder if that person lives with a person of a certain age (usually age 60 or older); rules differ between carriers regarding whether that other person must purchase a policy, and some carriers have additional requirements to qualify for a household discount.

Neither type of discount is available in some states.

Some carriers offer a discount if premiums are paid by electronic funds transfer.

What Plans Are Available?

NOTE: Starting January 1, 2020, Medigap plans sold to people new to Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C, F, and Hi Deductible F are no longer available to such individuals. If you already have one of these plans as of January 1, 2020 you’ll be able to keep your plan, and if you were eligible for Part A of Medicare before January 1, 2020 (except for individuals born on January 1, 1955) you’ll be able to switch to one of these plans if you meet any applicable underwriting requirements. Also, if you qualify for Medicare before January 1, 2020, but are not yet enrolled, you may be able to buy one of these plans.

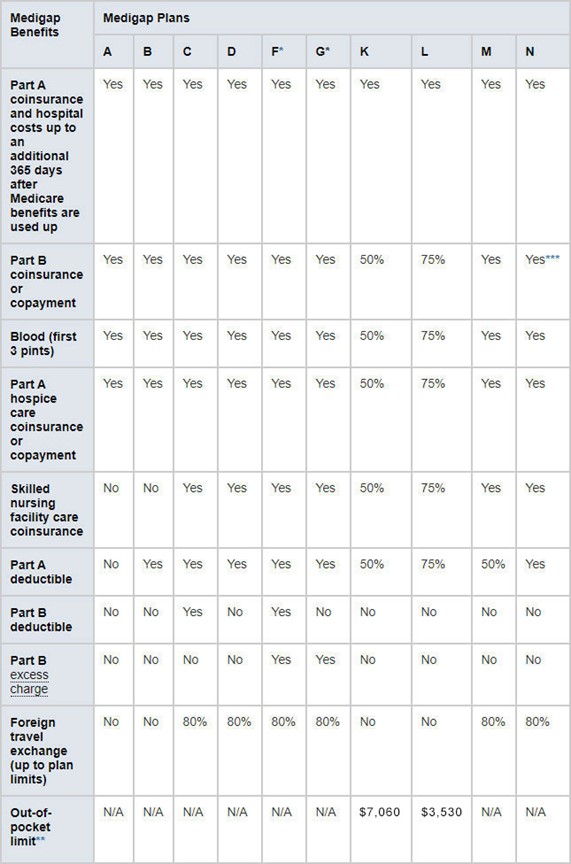

The chart below shows basic information about the different benefits Medigap policies cover in 2024.

Yes = the plan covers 100% of this benefit

No = the policy doesn’t cover that benefit

% = the plan covers that percentage of this benefit

N/A = not applicable

* Plans F and G (as well as the J plan that existed prior to 2010) also offer a high-deductible plan. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,800 in 2024 before your policy pays anything. (Plans C and F aren’t available to people who were newly eligible for Medicare on or after January 1, 2020 and Plan J has not been offered since 2010).

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in inpatient admission.

**** The deductible for the high deductible plans and the maximum out-of-pocket limits for plans K and L are adjusted annually in accordance with Federal law.

You live in Massachusetts, Minnesota, or Wisconsin

If you live in one of these 3 states, Medigap policies are standardized in a different way.

- You live in Massachusetts

- You live in Minnesota

- You live in Wisconsin

Note: we are not affiliated with or endorsed by any government entity or agency. We do not offer every plan available in your area. Currently we represent 19 organizations which offer 8 products in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE (TTY: 1-877-486-2048) 24 hours a day, 7days a week, or your local State Health Insurance Program (SHIP) to get information on all your options.