Medicare Overview

Medicare is a federal health insurance program that pays for a variety of health care expenses. It’s administered by the Centers for Medicare & Medicaid Services (CMS), a division of the U.S. Department of Health & Human Services (HHS). Medicare-eligibles are typically citizens or legal residents age sixty-five and older. Those with certain medical conditions (such as Lou Gehrig’s disease, end stage renal disease, or qualifying permanent disabilities) may also be eligible for Medicare benefits.

Like Social Security, Medicare is an entitlement program. Most citizens and legal residents earn the right to enroll in Medicare by working and paying their taxes for a minimum required period. Even if you didn’t work long enough to be entitled to Medicare benefits, you may still be eligible to enroll, but you might have to pay more.

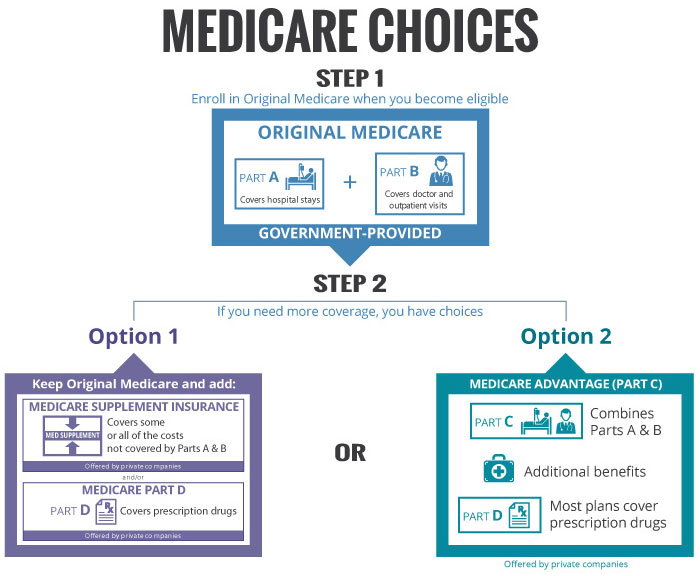

There are four different parts to the Medicare program. Parts A and B are often referred to as “Original” Medicare or “Fee for Service” Medicare. Both Medicare Part C (Medicare Advantage) and separate Medicare drug coverage (Part D) plans are offered through Medicare-approved private insurance carriers that must follow rules set by Medicare. Medicare Advantage plans can include Part D drug coverage, and, if so, they are referred to as Medicare Advantage Prescription Drug Plans.

You can learn more about Medicare at www.medicare.gov, which is the official site of CMS. Medicare & You 2024 is the official government handbook with information about Medicare. This handbook is mailed to all Medicare households each fall. It includes a summary of Medicare benefits, rights, and protections and answers to frequently asked questions about Medicare. The copy mailed to you contains an abbreviated list of available health and drug plans in your geographic area.

What You Need to Decide

Your biggest decision, and the one to make first, is whether you want Original Medicare (Part A and Part B) or Medicare Advantage (Part C). They cover the same basic services, but they work differently. Most Medicare Advantage Plans bundle together Part A, Part B and Part D (prescription drug coverage). And most Medicare Advantage Plans offer some extra benefits and lower out-of-pocket costs than Original Medicare. Your choice depends on what you need.

Once you decide, you’ll have other choices to make:

If you choose Medicare Advantage, you’ll have to pick a particular plan and decide whether you want a plan that includes coverage for outpatient drugs:

BUT

If you choose Original Medicare, you have more choices to make:

- You can elect to stay in Part A and B (“Original” Medicare) only.

- You can choose to supplement Original Medicare (Parts A and B) with a Medicare Supplement (also called “Medigap”) plan. Medicare Supplements are standardized in all states except MA, MN, and WI. There are ten basic standardized plans as well as the Hi Deductible F and HI Deductible G variations. Beginning January 1, 2020, if your birthdate is January 1, 1955 or later and you have not previously become eligible for Part A through disability, you won’t be able to buy Medicare Supplement plans that offer no deductibles (i.e., Plan C or F). Plan Hi Deductible F won’t be available, as well. Depending on your state, zip code, and carrier, one or more of the standardized plans may be available in a Medicare Select version.

You’ll also need to decide whether you want Medicare drug coverage (Part D) to cover your outpatient medications.

The following chart outlines your choices. You can obtain additional information by looking at the at this You Tube video.

We are not affiliated with or endorsed by any government entity or agency. We do not offer every plan available in your area. Currently we represent 19 organizations which offer 8 products in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE (TTY: 1-877-486-2048) 24 hours a day, 7days a week, or your local State Health Insurance Program (SHIP) to get information on all your options.