Don graduated from Loma Linda University (now La Sierra University) in Riverside with his bachelor’s degree prior to finishing his MBA in accounting from California State University at Dominguez Hills.

While in corporate accounting Don advanced his career to become a divisional controller for a major manufacturing corporation and completed the requirements for his Certified Management Accountant (CMA) designation.

Upon deciding to open his own practice Don completed the requirements for his Enrolled Agent (EA). An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee. Enrolled agent status is the highest credential the IRS awards. Individuals who obtain this elite status must adhere to ethical standards and complete 72 hours of continuing education courses every three years. Members of the National Society of Enrolled Agents are required to complete an addition 8 hours every year of continuing education on top of the Federal Minimum.

Enrolled agents have unlimited practice rights. This means they are unrestricted as to which taxpayers they can represent, what types of tax matters they can handle, and which IRS offices they can represent clients before. Learn more about enrolled agents in Treasury Department Circular 230 (PDF). http://www.irs.gov/pub/irs-utl/pcir230.pdf

Designations, Certifications, Etc.

- CMA – Certified Management Accountant

- EA – Enrolled Agent

- MBA – Master of Business Administration

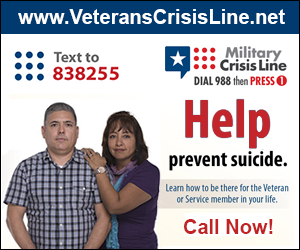

Proud Military Supporter!

Daughter served in Air Force and Uncle Army during WW II. Don has been a Trauma Intervention Program (TIP) volunteer.

Click The Buttons Below To Read My Reviews!