JL Smith is a boutique wealth and tax planning firm serving retirees and those preparing for retirement. We deliver professional, holistic expertise in financial areas like tax planning, investment management, insurance, and specialized Social Security planning. We offer an integrated suite of wealth management and financial planning services designed to care for the client’s entire financial picture.

Jason L. Smith, CEP, BPC – Founder/CEO

Jason is a speaker, financial planner, best-selling author, coach and entrepreneur. Following in his father’s footsteps as a second-generation advisor, he founded his financial services practice, JL Smith, in 1995 to provide clients with holistic financial planning services that align investments, insurance, tax planning, estate planning, Social Security strategies, and health insurance and Medicare into one comprehensive, coordinated plan.

With the overriding goal of improving the lives of American families, Jason also authored the best-selling book, The Bucket Plan: Protecting and Growing Your Assets for a Worry-Free Retirement. Additionally, he utilizes his experiences as an advisor to train other advisors through live training events, monthly coaching calls and study groups. To better fulfill this mission, he founded Clarity 2 Prosperity, a professional network for financial advisors nationwide, Prosperity Capital Advisors, an SEC-registered investment advisory firm, and Clarity Insurance Marketing, a fiduciary friend insurance organization.

Bryan Bibbo, AIF, NSSA, BPC – Partner | Accredited Investment Fiduciary

Bryan is a retirement planning professional who assists with estate and financial income planning as a Partner at JL Smith. He works with successful professionals, business owners, and retirees who are concerned with building and maintaining financial strategies to achieve total wealth optimization and a reliable income source in retirement. He strives to ensure every client feels confident, at ease, and content with their financial future.

In addition to holding licenses for Life and Health Insurance, Series 65, and the Annual Filing Season Program (AFSP) with the Internal Revenue Service, Bryan believes in having a roadmap retirement plan that accounts for withdrawals, taxes, risk tolerance, long-term care mitigation & inflation protections. Plus, the plan must be able to adjust as laws, taxes, and the economy change because there is no perfect, set it and forget it financial plan.

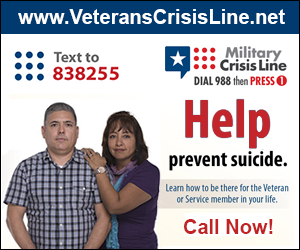

Joseph Voellm, CFF, ChFC, CLU, BPC – 8 Yrs Active Duty United States Marine Corps

Joe is a comprehensive financial advisor with a focus on retirement planning. Before entering the financial planning industry, he served 8 years on active duty in the United States Marine Corps. In that time, he deployed 4 times with 2 combat tours to Iraq, 1 pirate interdictory tour to East Africa, and 1 humanitarian relief tour to Haiti. While in the Marines, he successfully completed his undergraduate degree in finance.

Post military service he received his first master’s degree from Florida International University in Business Administration and his second masters from Texas Tech University in Personal Financial Planning. Additionally, he has a graduate certificate in Charitable Financial Planning. He is fully licensed and holds a Chartered Financial Consultant Chartered Life Underwriter designation from the American College. He is also a Certified Financial Fiduciary.

He loves that he genuinely gets to help families and his best advice is that the best time to take action is right now! There are so many interconnected aspects to financial planning that it takes a comprehensive approach to really achieve optimization.